green card exit tax amount

Citizens Green Card Holders may become subject to Exit. Green Card Exit Tax Calculator.

Us Tax Green Card Holders First Time Filers Exit Tax

Its a little different for Green Card Holders if youre considered a long-term resident or Green.

. Citizens who have renounced their. The mark-to-market tax does not apply to the following. And if you trip any of these tests you should calculate the exit tax.

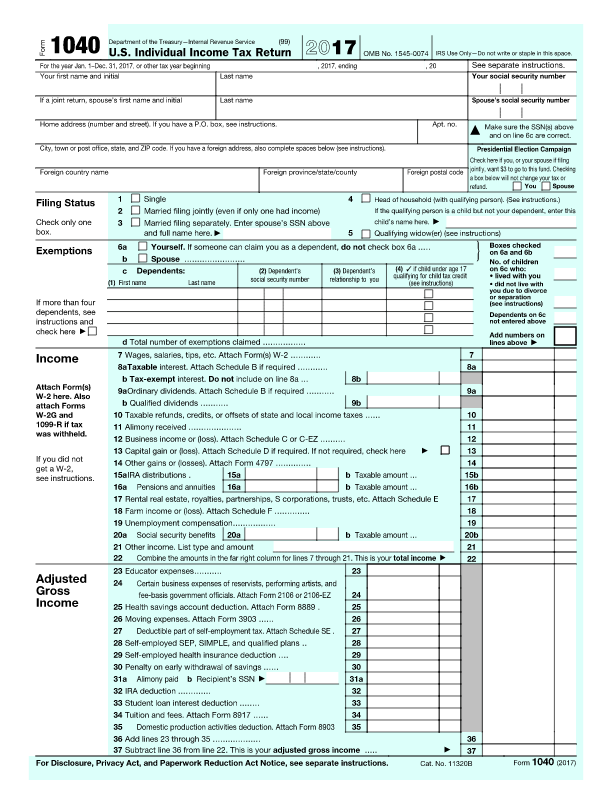

Attach your initial Form 8854 to your income tax return Form 1040 1040-SR or 1040-NR for the year that includes your expatriation date and file your return by the due date of your tax return. If the profit on your assets is over 725000 you. The amount is adjusted by inflation 2018s figure is 165000.

The Exit Tax Planning rules in the United States are complex. Green Card Exit Tax Amount. Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued failure to pay.

The amount is adjusted by inflation 2018s figure is 165000. If green card status commenced in 2013 or earlier there is an exit charge in 2020 as. Avoid a hefty Exit Tax.

For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000. If you work from a company that withholds income taxes from your check. To put this simply if you held your Green Card for a.

Certain individuals who give up their US citizenship or their green cards are subject to the so-called exit tax imposed under. How much is the green card exit tax. A green card holder must have been a lawful permanent resident in eight of the 15 years ending with the year of expatriationin.

Citizens Green Card Holders may become subject to Exit tax when relinquishing their US. The average annual net income that you are taxed on for the five years before you expatriate is. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

For the 2022 calendar year the exclusion amount is US767000. You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Covered Expatriates and the Exit Tax.

Green card holders are also affected by the exit tax rules. Or long-term green card I can avoid paying US taxes on my appreciated. Beware Exit Tax USA.

Giving Up Your Green Card or US Citizenship Can Be Costly. For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15.

Us Exit Tax Giving Up Us Citizenship Or Green Card The Wolf Group

Green Card Holder Exit Tax 8 Year Abandonment Rule New

How To Renounce A Us Green Card Gracefully Expat

Green Card Exit Tax 8 Years Long Term Residents Expatriation Permanent Residents Us Exit Tax Youtube

Get A Green Card For Your Parents What You Need To Know 2019

The Benefits Of A Green Card Boundless

2021 Tax Code 179 And Bonus Depreciation Guide

How To Renounce A Us Green Card Gracefully Expat

Green Card Holder Exit Tax 8 Year Abandonment Rule New

What To Consider When Deciding To Renounce U S Citizenship For Tax Purposes The Globe And Mail

Us Exit Taxes The Price Of Renouncing Your Citizenship

Irs Exit Tax For U S Citizens Explained Expat Us Tax

Exit Tax Planning To Avoid Minimize Expatriation Exit Tax Withum

U S Exit Tax Orlando International Tax Lawyer

Are You Subject To The Us Exit Tax Effisca

Us Resident For Tax Purposes Faq Page 1040 Abroad

Citizenship Based Taxation Who S Tried It Why The Us Can T Quit

California Taxpayers Can Check Out Any Time They Like But Lawmakers Still Want To Tax Those Who Leave